qocsuing's blog

Admiral Markets Review

Traders choose Admiral Markets (Admirals) for its excellent investor education and advanced MetaTrader features — such as the Supreme add-ons — alongside an extensive range of shares, forex and CFD markets, and premium research content.To get more news about admiral markets review, you can visit wikifx.com official website.

At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research and detailed forex guides, and we monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Our research team conducts thorough testing on a wide range of features, products, services, and tools (collecting and validating thousands of data points in the process). We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables.

We also take an in-depth look at each broker’s commissions and fees, such as bid/ask spreads – including the average spread data for some of the most popular forex currency pairs. We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and a range of other important fee-based data points.

Some of the other important research categories that are factored into our testing include mobile trading accessibility and capability, availability of market research and educational content, and each broker’s overall Trust Score.

For the ForexBrokers.com 2023 Annual Awards, brokers were evaluated against ForexBrokers.com’s 8 Primary Categories: Commissions & Fees, Offering of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

ForexBrokers.com also recognized brokers that demonstrated excellence and innovation with our exclusive Industry Awards. To see the complete list of Industry Award winners (and to learn more about our Annual Awards from our Director of Online Broker Research, Steven Hatzakis), check out our ForexBrokers.com Annual Awards page.

Pepperstone Review

Pepperstone offers a growing range of tradeable markets, good-quality research, and support for multiple social copy trading platforms.To get more news about pepperstone review, you can visit wikifx.com official website.

It offers both MetaTrader and cTrader (finishing Best in Class for MetaTrader brokers in 2023), and its wide range of available third-party tools and plugins enhances its already-impressive suite of available platforms.

While there are 2,342 symbols shown in Pepperstone’s MetaTrader 5 (MT5) platform, some of these are actually duplicates. That being said, there are more than 1,000 distinct markets available for trading – including forex and CFDs.

Cryptocurrency: Cryptocurrency trading is available at Pepperstone through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

Pepperstone is an agency-execution broker that offers excellent pricing on its Razor account when combined with its Active Trader program for high-volume traders. Meanwhile, its Standard account is not as impressive, and features comparably higher spreads.

Razor account: The Razor account can be used with either the MetaTrader (MT4 or MT5) platforms or cTrader platforms, and follows a commission-based pricing structure (in addition to prevailing spreads). Pepperstone listed an average spread of 0.17 pips for the EUR/USD on its Razor account (as of September 2022). When including the commission-equivalent of 0.70 pips, the all-in cost jumps to 0.87 pips – which is slightly higher than the industry average.

Standard account: Pepperstone’s Standard account is commission-free, and has listed an average spread of 0.77 pips on the EUR/USD (as of September 2022). When considering the Razor’s all-in cost of 0.87 pips (including commission), the Standard account stands out as a more affordable option.

Active traders: Pepperstone's Active Trader program will rebate a portion of the spread, depending on your monthly trading volume and the applicable tier.

United Kingdom and EU: Professional clients that trade at least $10 million per month (100 standard lots) can be eligible for the Tier One rebate of 5% per lot. Tier Four rebates can be negotiated for those who do more than 500 lots monthly.

Australia: For Professional clients, a minimum of 100 lots is required (over a three month period) to qualify for the lowest tier in Pepperstone's Active Trader program. Tier One provides a discount of 5% per standard lot, which reduces the effective spread. Tier Three – available to those who trade more than 200 lots monthly – provides a 15% spread reduction.

There are multiple third-party platform options for mobile trading at Pepperstone. While these apps provide a reliable trading experience, our testing has found that proprietary apps are a factor that can set the highest-ranked brokers apart from the competition.

Apps overview: Traders have access to the MetaTrader suite of mobile apps (MT4 and MT5), as well as the cTrader mobile app – all of which are available directly from their respective developers on Google Play (for Android) and Apple App Store (for iOS).

Aston Martin Vantage review

The first all-new Aston Martin sports car since the Vantage rejoined the ranks in 2005 is not – we repeat, not – merely a Mercedes-AMG GT in a Savile Row dinner jacket. Yes, the new baby Aston Martin shares its 4.0-litre, twin-turbo engine with AMG’s finest – and some of its interior technology – but beyond that, this is all Aston. And it’s a very fine piece of work.To get more news about vantage review, you can visit wikifx.com official website.

And don’t think that just because the Vantage sits on a shortened version of the DB11’s aluminium platform, and shares its eight-speed automatic gearbox, that it’s more Aston reheated leftovers. Aston kept the DB11 deliberately soft and gentlemanly so the shorter, lighter Vantage could be punchier, angrier and more of a sports car. Finally, some clear daylight between Aston Martin’s products.

The gearbox is sharper. The electronic rear differential is lightning-fast in its reactions, to maximise traction (or yobbery, depending on your mood). There’s no longer a Comfort mode for the powertrain and chassis – this time everything’s gone up a notch, with Sport, Sport + and Track modes to choose from. Heck, there's even a seven-speed manual gearbox available. You won't find that in any of Aston's other models.

There’s more than one now. The regular engine develops the same 503bhp and 505lb ft as in the Mercedes-AMG C63 (though torque's down a smidge in the manual), which is enough to get the 1.5-tonne Vantage from 0-62mph in 3.6 seconds and on to a top speed of 195mph. Those figures climb to 4.0secs and 200mph with the stick-shift transmission. That’s huge performance from an entry-level model, but necessary now the Vantage has an options-free entry price of £120,000 and has to compete with the likes of the Audi R8 V10 Plus, McLaren 540C and Porsche 911 Turbo.

There’s a soft-top Volante but the coupe gets other power options. There’s an uprated F1 Edition that’s £18,000 more and boosts the V8 to 527bhp. That car, although not as attack-orientated as a Porsche 911 GT3 is the more track-focused machine, the one that leads the F1 circus around as the safety car. Then there’s the V12 Vantage. It’s so different we’ve given it a whole review to itself, but it’s worth running through the basics here: 690bhp and a 200mph top end. That ought to do it. It somehow conspires to be less than the sum of its parts, though.

Aston Martin struggles at new cars, traditionally. Oh, it gets them right eventually. But take the DB9, the last Vantage, even the DB11 – we tend to remember them most fondly for what they morphed into throughout their lives, not how they first emerged.

The new Vantage is, mostly, different. Slightly dead steering and lazy automatic gearbox aside – and those are minor gripes, we promise – this thing feels far better sorted than the car it replaces. It sounds wonderful, looks fabulous, goes like stink and has an extremely capable, if slightly inert unless you’re going ballistic, chassis.

Is the Vantage special enough for £120,000 and up? Look, it ain’t as dramatic as the mid-engined Audi R8, but now McLaren (540/570) and Mercedes (AMG GT) have withdrawn from this sector, the Vantage has less direct competition. Of course they’ve left because the competition from Porsche is so hot. The 911 is a phenomenal sports car, and Aston has deliberately priced the Vantage high to add distance. But the badge, the image, the desirability allow Aston to add this brand tax and get away with it.

Fibo Group Guide - Read our In Depth 2023 Fibo Group Review

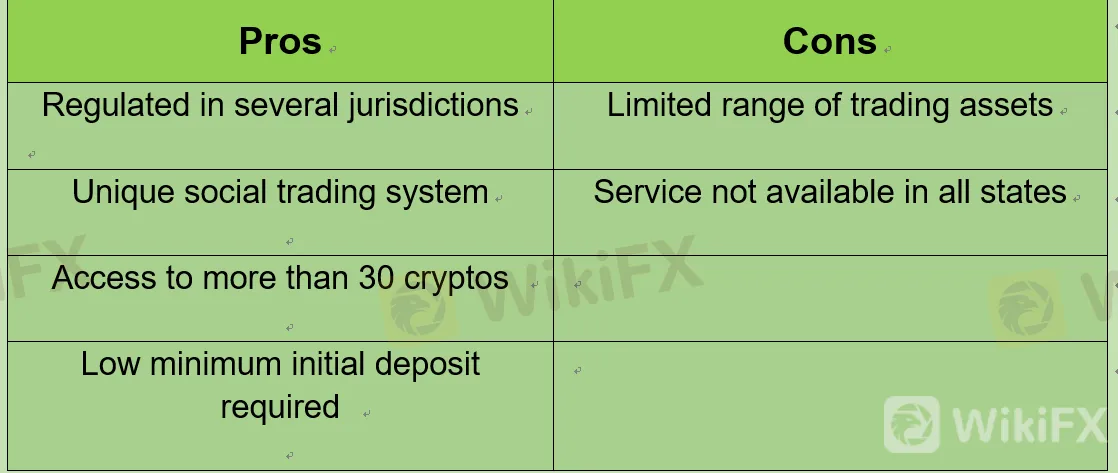

Often you have to visit and read many broker websites all of which have different uses of language. The wording can be very confusing. Choosing an online broker like Fibo Group can be difficult. Some Fibo Group trading features can be complex when trading on mobile or using the Fibo Group online trading platform. Beginners and inexperienced traders may face hard to understand investment terminology and confusing fee structures and must take the time to learn how to use the Fibo Group trading tools properly. In our review of Fibo Group we breakdown the pros and cons. What Fibo Group are able to offer, what countries Fibo Group are available in. Who Fibo Group are regulated by and more.To get more news about fibo group review, you can visit wikifx.com official website.

Having a reliable and capable broker is crucial to your success in online trading. Make sure that your broker is not fake or unreliable to avoid losing your investment. In order for you to have a good working profitable relationship, ensure that your needs fit the profile of your broker as well.

This is why we have taken the time to review only the best brokerage firms, their practices, their fee structure and all other important aspects. We want you to evaluate, analyse, and trust your hard-earned cash with only the most trustworthy and best of brokers. We hope you find this Fibo Group review useful.

This review of the Fibo Group platform is very detailed. If you are interested in trading with Fibo Group in any capacity please take the time to read and research the whole Fibo Group review.

We have tried to explain the ins and outs of financial trading through the Fibo Group platform as plainly as possible so that you the trader are as informed as possible before you start to use the Fibo Group trading tools and depositing and withdrawing funds from Fibo Group.

Investing online can be just as risky as any other kind of offline investment. As with any investment, it is important to know and research the company you are dealing with. When trading financial assets with Fibo Group like Forex trading, and Social trading. You should have confidence in Fibo Group and know that the management of your financial investments on the Fibo Group platform are in good hands.

At the bottom of this Fibo Group review you can also learn about some pretty good alternatives to Fibo Group

With this Fibo Group review we hope to help you see if Fibo Group is a good fit for you.

It is a common myth that online trading is easy. Online trading is difficult and traders must do their own research and have a clear understanding of what they are doing. In this article, you will learn important information regarding Fibo Group that will help you get off to a good start in the world of online trading.

Fibo Group trades in multiple financial asset types. A financial asset is any security or asset that has financial value attached, tangible or intangible. This means that Forex, Social Trading are considered financial assets.

Are Fibo Group safe?

When choosing a broker like Fibo Group the administrative body and regulatory status of the broker is very important. Brokers who conduct trades without supervision of a regulatory body do so at their own discretion. Any capital you invest is at risk.

Established in 1998, and in operation for 25 years Fibo Group have a head office in British Virgin Islands.

Fibo Group is regulated. This means Fibo Group are supervised by and is checked for conduct by the Financial Conduct Authority (FCA) regulatory bodies.

Regulated brokers are highly unlikely to manipulate market prices due to the regulations imposed. When you send in a withdrawal request to Fibo Group, this will be honored. If Fibo Group violate any regulatory rules their regulated status could be stripped.

Saxo Bank Review

Saxo Bank is an exclusive multi-asset broker with brilliant research and a superb trading platform experience – as well as a stunning selection of over 60,000 tradeable instruments.To get more news about saxo review, you can visit wikifx.com official website.

For active traders (or those who can afford to maintain the steep account balance requirements), Saxo Bank provides an immersive, rich trading experience with a towering selection of tools, research, and premium features.

Saxo Bank is a multi-asset broker that offers investors and traders a vast selection of more than 60,000 tradeable symbols. In addition to electronically-tradeable markets that span nearly every asset type, Saxo Bank offers spot FX, FX options, non-deliverable forwards (NDFs), Contracts for Difference (CFDs), stocks, stock options, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), futures, and 33,000 bonds (available only via phone).

Exchange-traded securities: In addition to trading CFD shares, Saxo Bank also offers ISA/SIPP accounts for share dealing. To learn more, see our U.K. StockBrokers.com review of Saxo Markets.

Cryptocurrency: Cryptocurrency trading is available through derivatives, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

Overall, Saxo Bank delivers excellent all-around pricing. For active traders, and those able to maintain large account balances, Saxo Bank offers the lowest pricing in the industry.

Pricing summary: In August 2020, the average EUR/USD spreads were 0.8, 0.7, and 0.6 pips, for the Classic, Platinum, and VIP accounts, respectively. Bottom line: pricing for the Platinum and VIP accounts ranks among the best forex brokers, while the Classic account is closer to the industry average.

Classic account minimums: The entry-level Classic account requires a €2,000 minimum deposit in most cases, though the minimum deposit may vary depending on your country of residence.

Platinum account minimums: The minimum deposit for the Platinum account is $200,000 – or AUD 300,000 if you reside in Australia. Traders with the Classic account can qualify to be upgraded to Platinum by earning volume-related Loyalty points through Saxo Bank’s Loyalty Program. For example, trading over $40 million worth of forex would earn you 120,000 points – which would be enough to upgrade from Classic to Platinum for 12 months.

VIP account minimums: For 2023, Saxo Bank won our award for Best VIP Client Experience. Saxo Bank’s VIP account, which offers the most savings on pricing, is reserved for elite investors who either deposit at least $1,000,000, or who qualify to be upgraded under Saxo Bank’s Loyalty Program. Traders looking to have their account tier upgraded to VIP would need to trade at least $167 million in forex volume – this upgrade would be valid for one year. The VIP account also provides access to exclusive events and connections to Saxo Bank analysts.

Commission-free: Saxo Bank is commission-free, which means it makes money off the spread. There is one exception; traders who trade less than 50,000 units (half of one standard lot) per month are charged a ticket-fee of $3 per side.

Best execution: Saxo Bank is committed to the FX Global Code, an evolving interbank standard focused on enhanced disclosures and execution best practices. The mission of the FX Global Code is to promote integrity and transparency across the global foreign exchange market.

Plus500 Review

Plus500 is a trusted global brand that offers an easy-to-use trading platform for online traders, alongside access to share trading via the Plus500 Invest platform and a thorough selection of CFDs through the broker’s separate Plus500 CFD platform.To get more news about plus500 review, you can visit wikifx.com official website.

Plus500’s simplified trading platform attracts beginners looking for a user-friendly experience, but its limited educational content and narrow selection of market research will leave active traders wanting more.

Unlike brokers who offer non-deliverable spot forex as a rolling contract, all forex trading at Plus500 is done by way of CFDs. Plus500 launched shares trading in 2021 via Plus500 Invest, and also acquired a futures firm in the U.S. The table below summarizes the different investment products available to Plus500 clients.

Cryptocurrency: Cryptocurrency trading is available through CFDs, but not available through trading the underlying asset (e.g., buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker's U.K. entity, nor to U.K. residents.

The table below summarizes the CFD investment products available at Plus500. Non-CFD shares are only available through the broker's Plus500 Invest platform.

Overall, Plus500's pricing is in line with the industry average but trails the best forex brokers when it comes to active trader pricing (see IG or Saxo Bank for comparison). Plus500 does not provide discounts to retail clients, but does offer cash rebates (akin to an active trader program) if you qualify and are designated as a Professional client.

Spreads: For the EUR/USD, the Plus500 platform displays a dynamic spread of 0.00008 (0.8 pips). Accordingly, the average spread from Plus500 for the EUR/USD during August 2021 was 0.8 pips, which is in line with the industry average.

The look, feel, and functionality of the Plus500 trading app closely mirrors the WebTrader browser platform, offering a satisfyingly seamless transition between platforms.

That said, like its WebTrader counterpart, the Plus500 trading app lacks the advanced tools and all-around functionality to challenge industry leaders. As an example, Plus500’s web charts do not sync with the mobile app – a feature you’ll find within the trading apps available at Saxo Bank and TD Ameritrade (U.S. residents only).

Trading tools: Plus500 has significantly improved its charting, offering 109 indicators and over 20 drawing tools. However, there remains plenty of room for improvement, and I’d like to see an increase in the number of features, such as news, research, and advanced trading tools – all of which are currently absent from Plus500’s mobile app.

The Plus500 web trading platform, WebTrader, is an excellent choice for casual investors due to its ease of use and its focus on providing just the essentials. Plus500 has continued to make minor improvements to its platform over the years, and as those enhancements have stacked up, Plus500 has edged closer to competing with the industry leaders in this category.

Platforms overview: Plus500’s web trading platform continues to be refined, and features pre-defined watchlists, the ability to add alerts on client sentiment data, and an economic calendar that displays related news powered by Dow Jones, and instrument information from Yahoo Finance that appears when viewing a given symbol.

While the desktop version of the app is no longer supported, the web version meets the requirements of a progressive web app and is installable as a Chrome app.

Charting: The Plus500 web platform features 110 indicators, over 20 drawing tools, and 13 different chart types. Though indicators are not automatically saved within the platform, you bypass this issue by instead saving your chart templates. It’s also worth noting that your chart settings won’t sync with the Plus500 mobile app, so they won’t carry over across devices. Overall, I was impressed, and I found Plus500 charts to be a smooth, responsive experience.

Ease of use: For newer traders, Plus500’s browser-based WebTrader is a great starting point before graduating to a more advanced platform. WebTrader is cleanly designed and focuses on simplicity. The few advanced features available within Plus500's flagship platform include trailing stops and guaranteed stop-loss orders (GSLO), which can be helpful risk management tools for casual traders.

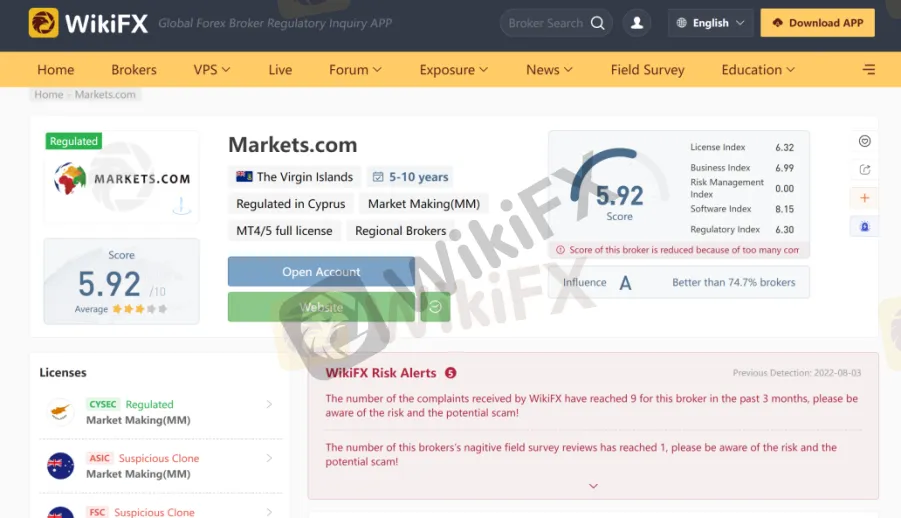

Markets.com Review

Traders in search of a comprehensive and reliable online platform with a wealth of account options and features will find great value in Markets.com. Markets.com was established in 2008 and is part of Finalto, a constituent of Playtech PLC, which is traded on the London Stock Exchange Main Market and is a constituent of the FTSE 250 Index.To get more news about markets.com review, you can visit wikifx.com official website.

Markets.com offers five region-specific account types for clients in Europe, South Africa, Australia, the UK, and other regions. The platform is currently unable to serve customers in the USA, Canada, Japan, Singapore and Belgium. Markets.com is globally recognized for its excellent trading options and stable platform and won Best Forex Trading Platform and Best Forex Provider at the 2017 UK Forex Awards, as well as the Best Trading Platform 2020 at FX Scouts.

Markets.com lives up to its name by providing traders with a broad sweep of the financial markets in its extensive selection of tradable assets. Customers can choose from a staggering 2200 assets, including currency pairs, precious metals, a wide selection of global shares, bonds, ETFs, cryptocurrencies and several innovative blends including a trade war blend and Warren Buffett blend. Markets.com has developed a proprietary, easy-to-use trading platform (Web Trader) and also supports MetaTrader 4 and 5. Exceptionally low spreads (starting from 0.6pips), leverage of 1:30-1:300 (depending on the account type and jurisdiction)and powerful trading tools are some of the key features and benefits that traders can expect from Markets.com.

RISK WARNING: 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

New, experienced and professional traders will find the Markets.com platform and its features to be comprehensive and easy to access. The platform’s tools and analysis section contains several useful resources including financial news, analysis reports, insider market updates and bloggers’ opinion summaries. Technical analysis features include basic and advanced charting, market signals and full commentary from the Markets.com trading advisory team.

The platform is covered by a total of five financial jurisdictions, including two tier-1 regulators. The EU, UK, Australia, South Africa, and British Virgin Islands jurisdictions ensure client funds segregation, while the extent of investor compensation varies across their respective regulators. Leverage limits vary across account types (retail/professional) and jurisdiction, with a maximum leverage of up to 1:300 available. For retail clients under ASIC, FCA, and CySEC entities, the leverage is capped at a maximum of 1:30 in accordance with regulations. Leverage limits vary by asset class, with forex enjoying the highest ratios. Investor compensation protection and leverage limits are all outstanding features of Markets.com’s offering. The maximum leverage available to professional traders are 1:300.