Gold Surges as Biden Sworn In as US President from wisepowder's blog

The gold market saw a V-shaped rally on Wednesday as Joe Biden was being

sworn in as 46th president of the United States. Spot gold rebounded to

$1,850/ounce from $1,832.30, after touching a high of $1,860.To get

more news about WikiFX, you can visit wikifx official website.

“Much of today's rally is just investors believing that you are going to see the Biden administration work nicely with the Treasury in providing a significant amount of stimulus in the first 100 days,” said Edward Moya, senior market analyst at OANDA .

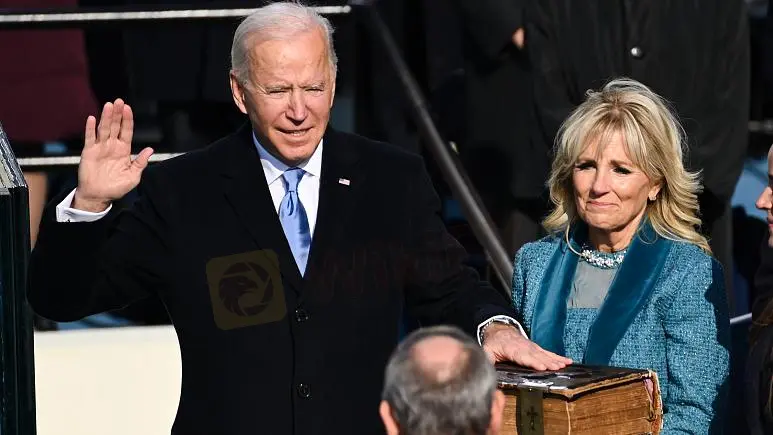

This image has been resized to fit in the page. Click to enlarge.

This image has been resized to fit in the page. Click to enlarge.

“The $1,900 level is likely to be short-term resistance this week, and if the rally continues to see strong support, I wouldn't be surprised to see gold at $1,950 by the middle of next month,” Moya added.

Meanwhile, there is still a lot of uncertainty when it comes to the vaccine rollout, growing case numbers, and new virus variants.

“One of the concerns is that the South African virus strain would potentially become a big problem. The worry is that the mutation is resistant to anti-body neutralization, which means that vaccines might not be able to protect from re-infection,” Moya noted. “This raises expectations that we are going to see lockdowns a lot longer, and it will force more fiscal efforts, which will be the backbone for gold prices.”

Use WikiFX to discern market trends, capture trading opportunities and make more profits.

Its a busy day ahead on the economic calendar. Prelim January private sector PMI figures for France, Germany, and the Eurozone are due out later today.

While Germany‘s manufacturing and the Eurozone’s PMI will be key drivers, any weak numbers would test support for the EUR.

With lockdown measures continuing into January, service sector activity will likely take a hit. To what extent and whether the manufacturing sector is also affected remains to be seen.

“Much of today's rally is just investors believing that you are going to see the Biden administration work nicely with the Treasury in providing a significant amount of stimulus in the first 100 days,” said Edward Moya, senior market analyst at OANDA .

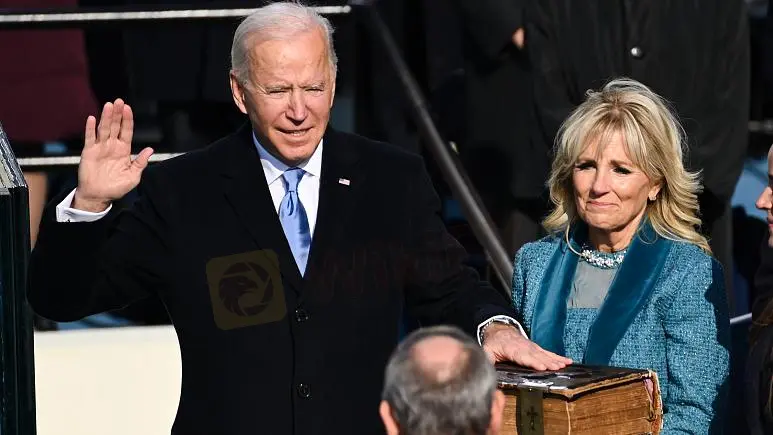

This image has been resized to fit in the page. Click to enlarge.

This image has been resized to fit in the page. Click to enlarge.“The $1,900 level is likely to be short-term resistance this week, and if the rally continues to see strong support, I wouldn't be surprised to see gold at $1,950 by the middle of next month,” Moya added.

Meanwhile, there is still a lot of uncertainty when it comes to the vaccine rollout, growing case numbers, and new virus variants.

“One of the concerns is that the South African virus strain would potentially become a big problem. The worry is that the mutation is resistant to anti-body neutralization, which means that vaccines might not be able to protect from re-infection,” Moya noted. “This raises expectations that we are going to see lockdowns a lot longer, and it will force more fiscal efforts, which will be the backbone for gold prices.”

Use WikiFX to discern market trends, capture trading opportunities and make more profits.

Its a busy day ahead on the economic calendar. Prelim January private sector PMI figures for France, Germany, and the Eurozone are due out later today.

While Germany‘s manufacturing and the Eurozone’s PMI will be key drivers, any weak numbers would test support for the EUR.

With lockdown measures continuing into January, service sector activity will likely take a hit. To what extent and whether the manufacturing sector is also affected remains to be seen.

The Wall